Alimony and Spousal Support in Texas: Laws, Types, Eligibility, and Expert Legal Help

Divorce often brings significant changes, especially in finances. Understanding how alimony and spousal support work in Texas can help you navigate these changes confidently. Texas has strict rules about spousal support, focusing on fairness and temporary assistance to help one spouse become self-sufficient.

This guide breaks down everything you need to know, from eligibility and types of support to enforcement and tax implications, so you can approach the process with clarity.

Understanding Alimony and Spousal Support in Texas

When talking about alimony, it’s easy to feel overwhelmed by the legal terminology. What’s the difference between alimony and spousal support? Does Texas handle these differently than other states? This section clears up those questions, helping you understand the basics before diving into the specifics.

What is Alimony in Texas?

Alimony, also called spousal maintenance in Texas, refers to payments made by one spouse to the other after divorce. These payments are meant to help the lower-earning spouse manage living expenses while adjusting to financial independence.

What is Spousal Support in Texas?

Spousal support is a broader term that includes both voluntary payments between spouses and court-ordered spousal maintenance. In Texas, court-ordered support follows strict legal requirements.

Texas Alimony Laws

Unlike some states, Texas does not grant alimony automatically. Laws focus on providing temporary support and limit the duration and amount of payments. This ensures that spousal maintenance is only awarded when it’s genuinely needed.

Spousal Maintenance vs. Alimony Texas

Many people use these terms interchangeably, but Texas makes a distinction. Spousal maintenance is court-ordered financial assistance, while alimony can also refer to voluntary agreements outside the courtroom.

Eligibility and Determination of Alimony

Not everyone qualifies for alimony in Texas. Understanding whether you’re eligible—and how courts decide the details—can save you time and stress. This section outlines who qualifies, what factors courts consider, and how payments are calculated.

Who Qualifies for Alimony in Texas?

Texas law requires the spouse requesting alimony to meet specific criteria, like a marriage lasting at least 10 years or a significant disability. If you’re unsure whether you qualify, this is where to start.

Factors for Alimony in Texas

Courts don’t just look at finances—they consider factors like the length of the marriage, contributions to the family, and even misconduct like infidelity. Knowing what matters can help you prepare your case.

How is Alimony Determined in Texas?

Texas doesn’t have a standardized calculator for alimony, but courts base decisions on income, expenses, and the recipient’s needs. Payments are capped at 20% of the paying spouse’s income or $5,000 per month, whichever is lower.

Types of Spousal Support in Texas

Not all spousal support is the same. Depending on your circumstances, you might qualify for temporary help during the divorce, rehabilitative support to get back on your feet, or even permanent support in rare cases. This section explains the differences.

Temporary Spousal Support Texas

Divorce can take months or even years, and temporary spousal support helps cover immediate needs during this time. It ensures that the lower-earning spouse can manage essentials while the case is ongoing.

Rehabilitative Spousal Support Texas

This type of support helps the recipient gain job skills or education to become financially independent. It’s ideal for someone who may have stepped away from the workforce during the marriage.

Permanent Spousal Support Texas

While rare, permanent support is available in situations involving long-term marriages or severe disabilities. Texas courts aim to keep these cases fair while limiting indefinite payments.

Minimum and Maximum Alimony in Texas

Texas courts don’t set a minimum amount for alimony, but there is a clear maximum: $5,000 per month or 20% of the payer’s gross income. This ensures payments are reasonable and not overly burdensome.

High-Asset Divorce Alimony Texas

High-asset divorces bring unique challenges, especially when it comes to dividing investments, properties, and other valuable assets. Courts consider these complexities when deciding on spousal support.

Duration and Modification of Alimony

How long does alimony last? What if circumstances change? Texas courts consider the length of the marriage and specific needs when setting durations, but they also allow for modifications if something significant changes later.

How Long Does Alimony Last in Texas?

The duration depends on how long you were married. For example, a 10–20 year marriage might result in payments lasting up to 5 years, while longer marriages may lead to longer support periods.

Below is a table that outlines the duration of spousal maintenance (alimony) based on the specific circumstances of the marriage and divorce under Texas law:

| Marriage Duration | Alimony Duration |

|---|---|

| Less than 10 years | Typically not eligible, unless the recipient spouse has a disability or special circumstances. |

| 10 – 20 years | Up to 5 years, depending on the court’s discretion and the financial needs of the recipient. |

| 20 – 30 years | Up to 7 years, based on factors like the recipient’s ability to become self-sufficient. |

| 30 years or more | Up to 10 years, reflecting the length of the marriage and the financial dependency of the recipient. |

| Recipient has a permanent disability | Indefinite, as long as the disability persists and the court deems the support necessary. |

| Domestic violence involved | Up to 5 years, if the marriage lasted less than 10 years, but the spouse was convicted of family violence. |

Factors Influencing Alimony Duration

- Recipient’s Financial Need: Courts consider whether the recipient can meet their basic needs without support.

- Ability to Pay: The paying spouse’s income and financial obligations influence the court’s decision.

- Efforts Toward Self-Sufficiency: Recipients are expected to work toward financial independence during the alimony period.

- Special Circumstances: Disabilities, health issues, or care for a dependent child may extend the duration.

Can Alimony Be Modified in Texas?

If your financial situation changes—like losing a job or receiving a big promotion—you can ask the court to adjust your alimony agreement. This flexibility ensures payments remain fair over time.

Termination of Alimony Texas

Alimony doesn’t last forever. It typically ends if the recipient remarries, cohabitates with a new partner, or if either spouse passes away.

Applying for and Enforcing Alimony

The process of requesting or enforcing alimony can feel complicated, but understanding the steps makes it easier. From applying for support to ensuring payments are made, here’s how to handle the process effectively.

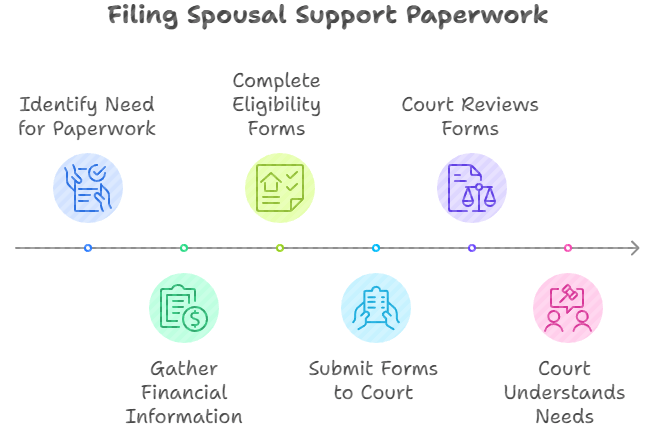

How to Apply for Spousal Support in Texas

To apply for spousal support, you’ll need to complete forms that detail your financial situation and reasons for needing help. Consulting a lawyer can make the process smoother.

Spousal Support Forms Texas

Filing the right paperwork is essential. These forms outline your income, expenses, and eligibility, helping the court understand your needs.

How to Enforce Alimony Court Orders in Texas

If your ex-spouse isn’t paying, you can take legal action. Options like wage garnishment or contempt of court motions can ensure you receive the payments owed to you.

Tax and Financial Implications

Money matters can get complicated, especially when it comes to taxes. This section explains how spousal support affects your financial situation under current tax laws.

Is Alimony Taxable in Texas?

For divorces finalized after 2018, alimony payments are no longer considered taxable income for the recipient. They’re also no longer tax-deductible for the payer.

Tax Deductions for Alimony Texas

While new agreements don’t allow for deductions, older arrangements may still qualify. Check with a tax advisor to ensure compliance with current laws.

Prenuptial and Postnuptial Agreements

Prenups and postnups can make divorce simpler by setting clear expectations for spousal support. This section explores how these agreements impact alimony in Texas.

Texas Prenup Spousal Support Clauses

Prenuptial agreements often include terms about alimony, such as waivers or limits on payments. Courts usually enforce these agreements as long as they’re fair.

Postnuptial Agreements Texas Spousal Support

Postnups allow couples to modify or establish financial arrangements after marriage. These can include spousal support terms that simplify the divorce process.

Special Cases in Spousal Support

Some situations require special consideration, like high-asset divorces or stay-at-home spouses. This section addresses unique circumstances.

Spousal Support for Stay-at-Home Spouses Texas

Stay-at-home spouses who sacrificed careers to support the family often qualify for temporary or rehabilitative support, helping them transition into financial independence.

Alimony Laws for Retired Couples Texas

Retirement can change financial dynamics significantly. Courts consider fixed incomes and retirement savings when deciding spousal support for older couples.

Common Challenges and Solutions

Spousal support isn’t always straightforward. Whether you’re facing disputes or enforcement issues, knowing how to handle challenges can save time and stress.

Managing Alimony Disputes Texas

Disagreements over alimony are common. Mediation can help resolve issues, but legal action may be necessary in more contentious cases.

Common Mistakes in Spousal Support Cases Texas

Avoid errors like incomplete documentation or unrealistic demands. Working with a knowledgeable attorney ensures your case is handled properly.

FAQ: Addressing Specific Circumstances in Alimony and Spousal Support in Texas

Can self-employed spouses receive or pay alimony in Texas?

Yes, self-employed spouses can both receive and pay alimony in Texas. Courts will consider the income reported on tax returns and any additional documentation of business income or expenses. If a self-employed spouse underreports income, the court may investigate further to determine a fair alimony amount.

How does Texas handle alimony in cases involving same-sex marriages?

Texas applies the same alimony laws to same-sex marriages as to opposite-sex marriages. The duration of the marriage, financial need, and other eligibility factors are considered in determining spousal support, regardless of gender.

What happens to spousal support if the paying spouse loses their job?

If the paying spouse loses their job or experiences a significant decrease in income, they can request a modification of the alimony order. The court will evaluate the new financial circumstances and may adjust or temporarily suspend payments.

Can alimony be enforced if the paying spouse moves out of state?

Yes, alimony orders can be enforced across state lines under the Uniform Interstate Family Support Act (UIFSA). If the paying spouse moves, the receiving spouse can file an enforcement action in the new state to ensure continued payments.

Does spousal support change if the receiving spouse starts earning significantly more?

Yes, an increase in the receiving spouse’s income can be grounds for modifying or terminating spousal support. The paying spouse must file a petition with the court and provide evidence of the change in financial circumstances.

Can spousal support be denied if the requesting spouse committed adultery?

Texas allows courts to consider marital misconduct, including adultery, when deciding spousal support. While adultery doesn’t automatically disqualify someone, it can influence the judge’s decision to deny or reduce support.

What happens if a spouse hides assets to avoid paying alimony?

Hiding assets is illegal and can lead to severe penalties, including contempt of court, fines, or even imprisonment. If you suspect asset concealment, you can work with a forensic accountant or legal expert to uncover hidden income or property.

Is spousal support available in annulments?

No. Annulments treat a marriage as if it never existed, and Texas does not award spousal support in these cases. However, property disputes or claims of fraud might still lead to financial settlements.

How does remarriage affect spousal support?

If the receiving spouse remarries, alimony payments typically end immediately. Courts will terminate the order without further action from the paying spouse. Cohabitation in a marriage-like relationship may also result in termination, depending on the circumstances.

Can spousal support be negotiated without going to court?

Yes, spouses can negotiate spousal support terms through mediation or a private settlement agreement. Once agreed upon, the terms must be submitted to the court for approval to make them legally binding.

How does domestic violence affect spousal support?

If domestic violence occurred within two years before the divorce filing or during the marriage, the victimized spouse might have a stronger claim for spousal support. Texas courts prioritize safety and financial protection for victims.

Are stay-at-home parents more likely to receive spousal support?

Yes, stay-at-home parents often qualify for temporary or rehabilitative support if they lack immediate income or job skills. Courts recognize the contributions of stay-at-home parents to the marriage and consider their need for financial assistance.

How is spousal support handled if the receiving spouse is disabled?

For spouses with a disability that prevents them from working, courts may award long-term or even permanent spousal support. Medical documentation and expert testimony are often required to establish the severity of the disability.

What happens if a paying spouse declares bankruptcy?

Spousal support obligations are not dischargeable through bankruptcy. Payments must continue regardless of the bankruptcy filing. However, a paying spouse can request a modification if their financial situation changes significantly due to bankruptcy.

Can spousal support be included in a prenuptial or postnuptial agreement?

Yes, prenuptial and postnuptial agreements can outline specific terms for spousal support, including waivers or caps on payments. Courts will enforce these agreements unless they are deemed unconscionable or signed under coercion.

Are there limits to how much spousal support a wealthy spouse can be required to pay?

Yes, Texas caps spousal support payments at the lesser of $5,000 per month or 20% of the paying spouse’s gross monthly income. This applies even in high-asset divorces, though other financial arrangements, like property settlements, may supplement the recipient’s financial needs.

Can alimony be awarded in marriages lasting less than 10 years?

Yes, but only in limited circumstances, such as cases involving family violence or a disabled spouse who cannot support themselves. These exceptions must be proven in court.

Can a spouse receiving spousal support waive their right to collect it?

Yes, a spouse can voluntarily waive their right to spousal support, either in a prenuptial agreement or during divorce negotiations. Once waived, it is difficult to reinstate the right later.

How long does the process take to get spousal support approved?

The timeline depends on the complexity of the case, but temporary spousal support can be granted relatively quickly during divorce proceedings. Final spousal support orders are typically issued with the final divorce decree.

Secure Your Future with Expert Legal Guidance

Navigating the complexities of spousal support in Texas can be challenging. To ensure your rights are protected and to receive personalized guidance tailored to your situation, consider consulting with an experienced attorney. Nida Din, a dedicated family law attorney based in Austin, specializes in spousal support cases and is committed to providing compassionate and effective representation.

With a deep understanding of Texas alimony laws and a client-centered approach, Nida Din can help you achieve the best possible outcome in your case. Don’t face these legal challenges alone; reach out to Nida Din today at (512) 333-0715 to schedule a consultation and take the first step toward securing your financial future.